Who We Serve

Small business owners and entrepreneurs with drive, passion and commitment.

Small business owners and entrepreneurs with drive, passion and commitment.

A business owner may have a low credit score, limited collateral or previously been turned down for a loan by their bank, but CEDF will look at the applicant's character and complete situation. Unfortunate past events can complicate an owner's circumstances. But if you have the character, drive, passion and commitment to make your business successful, we are anxious to listen.

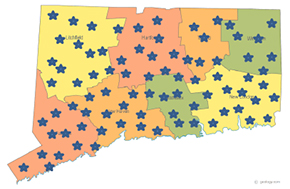

We specialize in lending to early-stage businesses not yet bankable, and existing businesses that cannot obtain a loan from a bank. We have a state-wide mission with a special emphasis on lending to the businesses located in Connecticut's cities and towns designated as either targeted or public investment communities, making them 'location eligible'. Alternately a business can be 'income eligible' if the owner's annual household income (Adjusted Gross Income) is less than $124,600.

Community Economic Development Fund

Community Economic Development Fund